1

U.S. Auto Parts Network, Inc.

Leading online source for automotive aftermarket parts and repair information

Investor Presentation

December 2011

Exhibit 99.1 |

1

U.S. Auto Parts Network, Inc.

Leading online source for automotive aftermarket parts and repair information

Investor Presentation

December 2011

Exhibit 99.1 |

Safe

Harbor 2

This

presentation

may

contain

certain

forward-looking

statements

and

management

may

make

additional

forward-looking

statements

in

response

to

your

questions.

These

statements

do

not

guarantee

future

performance

and

speak

only

as

of

the

date

hereof,

and

qualify

for

the

safe

harbor

provided

by

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

and

Section

27A

of

the

Securities

Act

of

1933.

We

refer

all

of

you

to

the

risk

factors

contained

in

US

Auto

Parts

Annual

Report

on

Form

10-K

and

quarterly

reports

on

Form

10-Q

filed

with

the

Securities

and

Exchange

Commission,

for

more

detailed

discussion

on

the

factors

that

can

cause

actual

results

to

differ

materially

from

those

projected

in

any

forward-looking

statements. |

3

US Auto Parts Competitive Advantages

US Auto Parts is a dominant e-commerce specialty retailer of aftermarket auto

parts to the Do It Yourself market and is uniquely positioned to

win.

Incremental

revenue

above

current

levels

has

incremental

EBITDA

flow

thru

of

15%

-

20% |

4

US Auto Parts History |

5

Broad Product Offering Unavailable

from Traditional Off-Line Retailers

Brake Discs

Catalytic

Converters

Radiators

Headers

Oxygen

Sensors

Alternators

Exhaust

Driveshaft

Fuel Injection /

Delivery

Lamps

Mirrors

Bumpers

Hoods

Tailgates

Doors

Grills

Wheels

Window

Regulators

Seat Covers

Car Covers

Floor Mats /

Carpeting

Cold Air

Intakes

Vent Visors

Tonneau

Covers

Nerf Bars

Bug Shields

Car Bras

Body Parts

Engine Parts

Performance & Accessories

*Source; AAIA Factbook Research

28%

44%

28%

$15B

$15B

USAP Revenue

Overall Market*

$50B |

6

Source : Forrester; Wall Street research; Autopartswarehouse.com

Low Online Penetration-

Mobile Growth

Opportunity |

Online

vs. Brick and Mortar Customer – Mobile Growth Should Accelerate

Penetration 7

Los Angeles DMA

0.6%

0.6%

1.4%

5.6%

6.0%

8.4%

12.6%

7.3%

15.9%

18.7%

22.7%

0.1%

0.7%

0.1%

9.8%

14.9%

5.3%

9.6%

18.1%

5.1%

16.4%

19.8%

0.2%

0.6%

0.6%

6.2%

7.4%

7.6%

10.3%

11.3%

11.9%

16.0%

27.8%

Varying Lifestyles

Urban Essence

Rural Villages & Farms

Metro Fringe

Blue Collar Backbone

Small Town Contentment

American Diversity

Struggling Societies

Affluent Suburbia

Upscale America

Aspiring Contemporaries

All Households

Auto Zone

USAP

Compared to AutoZone and the general population, USAP

customers over-index in affluent segments, typical of

e-commerce shoppers

Affluent Suburbia

The wealthiest households in the U.S. living in exclusive suburban

neighborhoods enjoying the best of everything that life has to offer

Small Town Contentment

Middle-aged, upper-middle-class families living in small towns and

satellite cities with moderate educations employed in white-collar,

blue-collar and service professions

American Diversity

A diverse group of ethnically mixed singles and couples, middle-

aged and retired with middleclass incomes from blue-collar and

service industry jobs

In contrast, AutoZone store locations over-index in areas with

lower income, blue collar households

Struggling Societies

Young minorities, students and single parents trying to raise families

on low-level jobs in manufacturing, health care and food services

Blue Collar Backbone

Budget-conscious, young and old blue-collar households living in

older towns working in manufacturing, construction and retail trades

Metro Fringe

Racially mixed, lower-middle-class clusters in older single-family

homes, semi-detached houses and low-rise apartments in

satellite cities

* |

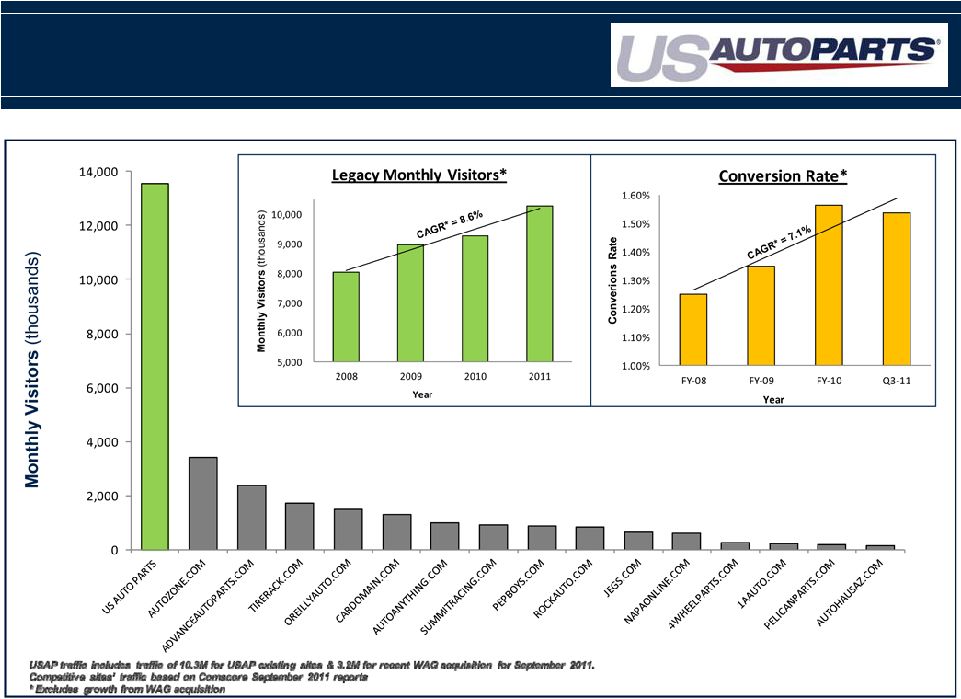

US

Auto Parts Dominant Reach- Largest

Pure Play Internet Retailer

(some overlap of monthly visitors across websites)

8 |

Pricing Competitive Advantage Through

Supply Chain Efficiencies

9

Product margin/price competitiveness determined more by sourcing strategy

than product categories. Current margins range from 32% -

34%.

Margin %

75%

25% |

Low

Cost Operating Structure Reduces Overhead and Enables Scale

10

Acquisition/Retention Marketing

Website Product Development

Call Center Operations

Product Sourcing

Catalog

Finance

Accounting

Analysis

IT

HR

Corporate Functions

Job functions are shared between the US and Philippines with a majority of the work

being performed in the Philippines. Total Corporate Employees

320

1,056

Distribution Centers

Carson, California (150,000 sq. ft.)

Chesapeake, Virginia (110,000 sq. ft)

LaSalle, Illinois (300,000 sq. ft)

106

90

Total Distribution Employees

196

99

99 |

1)

Improve Customer Experience

Continue to improve all customer touch points

1)

Lower Prices

Launch disruptive price points through supply chain

efficiencies

2)

Increase Selection

Expand product offering within existing categories as

well as entering new categories

3)

Increase Unique Visitors

Drive increase unique visitors both organically and

through acquisitions

4)

Be the Consumer Advocate for Auto Repair

Reduce consumer spending on vehicle repair by

billions of dollars

1)

Increase Gross Margins

Expand Private Label direct import SKU’s

Increase stock shipments of Branded product

2)

Leverage Revenue Growth

Every

incremental

dollar

yields

15%

20%

EBITDA

flow

thru

3)

Monetize Web Traffic

Sell advertising and sponsorship on new inventory

11

2011 Growth and Profitability

Revenue Growth

EBITDA Margin % Expansion |

$153.4

$176.3

$262.2

$328.8

2008

2009

2010

2011

$5.2

$13.5

$19.5

$17.8

2008

2009

2010

2011

12

Sales & Adjusted EBITDA

Consolidated Sales

Consolidated Adjusted EBITDA

($ In Millions)

($ In Millions)

1.

Excludes

legal

cost

associated

with

protecting

our

intellectual

property.

2.

Excludes

legal

cost

associated

with

protecting

our

intellectual

property,

one

time

charge

for

revenue

recognition

change,

and

acquisition

costs

3.

Analysts

Estimates

for

FY-11.

Source

–

Yahoo

4.

Includes

a

sales

increase

of

approximately

$38.6

million

and

$40.0

million

in

2010

and

2011,

respectively

from

partial

and

full

year’s

results

related

to

the

acquisition

of

J.C.

Whitney

Adj. EBITDA Margin

(1)

(2)

3%

5%

8%

10%

(3)

Year Impacted by:

•

Search

engine

changes

impacting

high

converting

sites.

•

Resolution

anticipated

in

2H

2012

•

JCW Acquisition

•

Integration

competed

in

Q4

2011

&

anticipate

return

to

profitability

(3,4)

(4) |

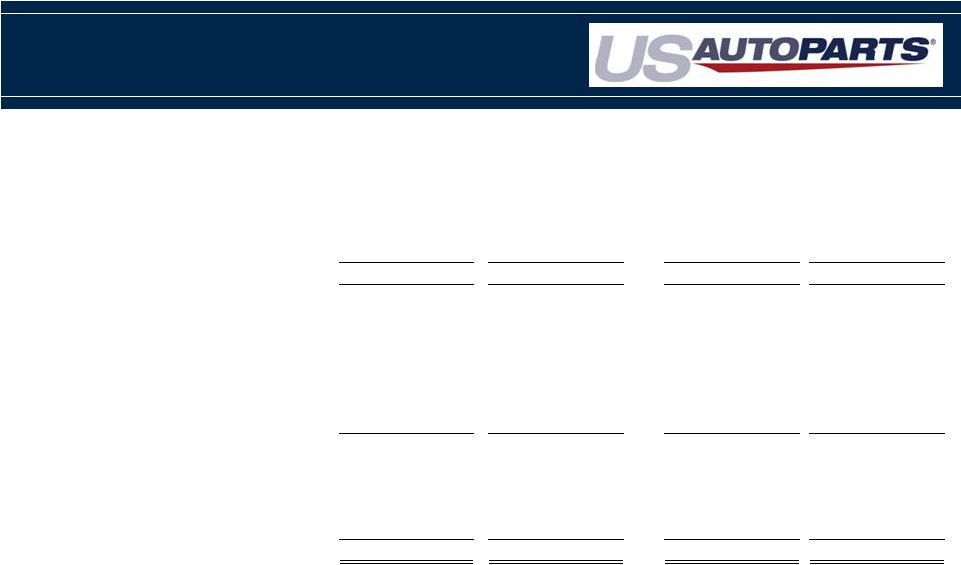

13

(millions$)

Growth

Base

10%

20%

30%

40%

50%

Revenue

Gross Margin

31%

-

34%

31%

-

34%

31%

-

34%

31%

-

34%

31%

-

34%

31%

-

34%

Variable:

Fufillment

Marketing

Technology

G&A

Total Variable

Fixed:

Fulfillment

Marketing

Technology

G&A

Total Fixed

Adjusted EBITDA

6%

-

9%

7%

-

10%

8%

-

11%

8%

-

11%

9%

-

12%

10%

-

13%

Adjusted EBITDA $

20

$

-

29

$

25

$

-

36

$

30

$

-

42

$

36

$

-

49

$

41

$

-

55

$

47

$

-

61

$

$488

14%

$325

$358

$390

$423

$455

2%

9%

1%

2%

14%

2%

9%

1%

2%

2%

9%

2%

14%

14%

9%

14%

14%

1%

2%

2%

1%

2%

9%

1%

2%

2%

1%

9%

2%

2%

4%

1%

3%

11%

9%

8%

8%

7%

2%

3%

1%

3%

2%

10%

3%

1%

3%

2%

3%

1%

2%

2%

1%

2%

2%

2%

3%

1%

2%

•

Reflects Whitney Automotive Group, fully integrated

•

Excludes stock based compensation, depreciation and amortization

•

For every incremental year required to achieve growth levels, fixed expenses

increase $1.2M Financial Sensitivity

Our

business

model

has

significant

cost

leverage

as

revenues

grow |

AutoMD-

Largest DIY Site

Repositioned to Target $140B DIFM Market

14 |

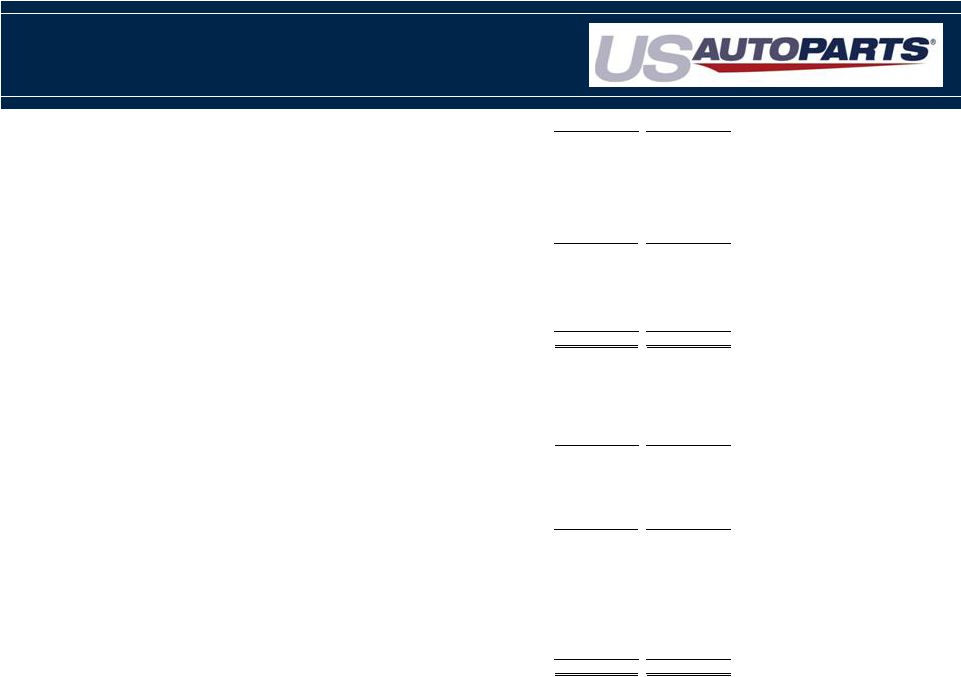

Adjusted EBITDA (Consolidated)

15

(Amounts shown in thousands)

Net (loss) income

$

(5,308)

$

(13,039)

$

(8,118)

$

(11,030)

Interest expense (income) net

283

187

719

132

Income tax provision

2

10,979

215

12,154

Amortization of intangibles

338

919

3,328

1,164

Depreciation and amortization

3,126

2,547

9,202

6,483

EBITDA

(1,559)

1,593

5,346

8,903

Share-based compensation

623

640

1,946

2,112

Legal costs to enforce intellectual property rights

211

306

443

2,199

Charge for change in revenue recognition

-

-

-

411

Add back Other Restructuring

3,815

1,590

6,591

1,590

Adjusted EBITDA

$

3,090

$

4,129

$

14,326

$

15,215

Thirteen Weeks

Ended

Thirteen Weeks

Ended

2010

2011

October 2

October 1

2010

2011

October 1

October 2

Thirty-Nine Weeks

Ended

Thirty-Nine Weeks

Ended |

Adjusted EBITDA excluding JC Whitney

16

(Amounts shown in thousands)

Net income

$

214

$

(10,136)

$

4,617

$

(8,127)

Interest expense (income) net

280

139

719

83

Income tax provision

2

10,979

160

12,154

Amortization of intangibles

125

124

375

369

Depreciation and amortization

2,514

2,197

7,364

6,132

EBITDA

3,134

3,303

13,235

10,611

Share-based compensation

623

640

1,946

2,112

Legal costs to enforce intellectual property rights

211

306

443

2,199

Charge for change in revenue recognition

-

-

-

411

Adjusted EBITDA

$

3,968

$

4,249

$

15,624

$

15,333

2011

2010

2011

2010

Thirteen Weeks

Ended

Thirteen Weeks

Ended

Thirty-Nine Weeks

Ended

Thirty-Nine Weeks

Ended

October 1

October 2

October 1

October 2 |

Income Statement (Consolidated)

17

Thirteen Weeks

Ended

Thirteen Weeks

Ended

Thirty-Nine Weeks

Ended

Thirty-Nine Weeks

Ended

October 1

October 2

October 1

October 2

2011

2010

2011

2010

78,593

$

72,349

$

249,839

$

181,828

$

54,248

48,342

166,664

119,617

24,345

24,007

83,175

62,211

14,002

11,145

41,953

25,496

9,096

8,156

25,739

20,288

4,449

4,102

14,048

10,269

1,676

1,665

5,531

3,841

338

919

3,328

1,164

29,561

25,987

90,599

61,058

(5,216)

(1,980)

(7,424)

1,153

201

134

279

185

(291)

(214)

(758)

(214)

(90)

(80)

(479)

(29)

(5,306)

(2,060)

(7,903)

1,124

2

10,979

215

12,154

(5,308)

$

(13,039)

$

(8,118)

$

(11,030)

$

(0.17)

$

(0.43)

$

(0.27)

$

(0.36)

$

30,571,472

30,357,988

30,521,529

30,225,194

Net sales

Cost of sales

Gross profit

Operating expenses:

General and administrative

(1)

Marketing

(1)

Fulfillment

(1)

Technology

(1)

Amortization of intangibles and impairment loss

Total operating expenses

(Loss) income from operations

Other income (expense):

Other income

Interest (expense) income

Other (expense) income, net

(Loss) income before income taxes

Income tax provision (benefit)

Net (loss) income

Basic net (loss) income per share

Shares used in computation of basic net income (loss) per share

|

October 1, 2011

January 1, 2011

ASSETS

(unaudited)

Current assets:

Cash and cash equivalents

15,151

$

17,595

$

Short-term investments

1,117

1,062

Accounts receivable,

net of allowance of $194 and $372, respectively 8,805

5,339

Inventory

45,717

48,100

Deferred income taxes

360

359

Other

current assets 4,444

5,646

Total current assets

75,594

78,101

Property and equipment, net

34,800

33,140

Intangible assets, net

15,456

18,718

Goodwill

18,854

18,647

Investments

2,104

4,141

Other non-current

assets 981

790

Total

assets 147,789

$

153,537

$

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

33,833

$

31,660

$

Accrued expenses

15,480

15,487

Notes Payable, current

portion 6,250

6,125

Capital Leases

payable, current portion 128

132

Other

current liabilities 7,454

5,522

Total current

liabilities 63,145

58,926

Non-current liabilities

Notes Payable, net of current portion

13,188

17,875

Capital Leases payable, net of

current portion 67

185

Deferred

tax liabilities 3,233

3,046

Other non current

liabilities 983

701

Total

liabilities 80,616

80,733

Commitments and

contingencies —

—

Stockholders’ equity:

Common stock, $0.001 par value; 30,587,401 and 30,429,376 shares

issued and outstanding as of 10/1/11 and 1/1/11,

respectively 31

30

Additional paid-in capital

156,372

153,962

Accumulated other comprehensive income

325

249

Accumulated deficit

(89,555)

(81,437)

Total stockholders’ equity

67,173

72,804

Total liabilities and

stockholders’ equity 147,789

$

153,537

$

Balance Sheet

18 |

Thank You

19

*

*

*

*

*

*

*****

*****

*****

*****

*****

*****

*****

***** |