UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of filing fee (check the appropriate box):

☒ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials. | |||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| | | 2050 W. 190th Street, Suite 400, Torrance, California 90504 |

| | |  | | |  |

DATE & TIME | | | PLACE | | | RECORD DATE |

Thursday, May 23, 2024 | | | CarParts.com, Inc., a Delaware Corporation | | | April 4, 2024 |

9:00 a.m. Pacific Time | | | 2050 W. 190th Street, Suite 400, Torrance, California 90504 | | | You can vote if you were a shareholder of record on April 4, 2024 |

To the Stockholders of CarParts.com, Inc.:

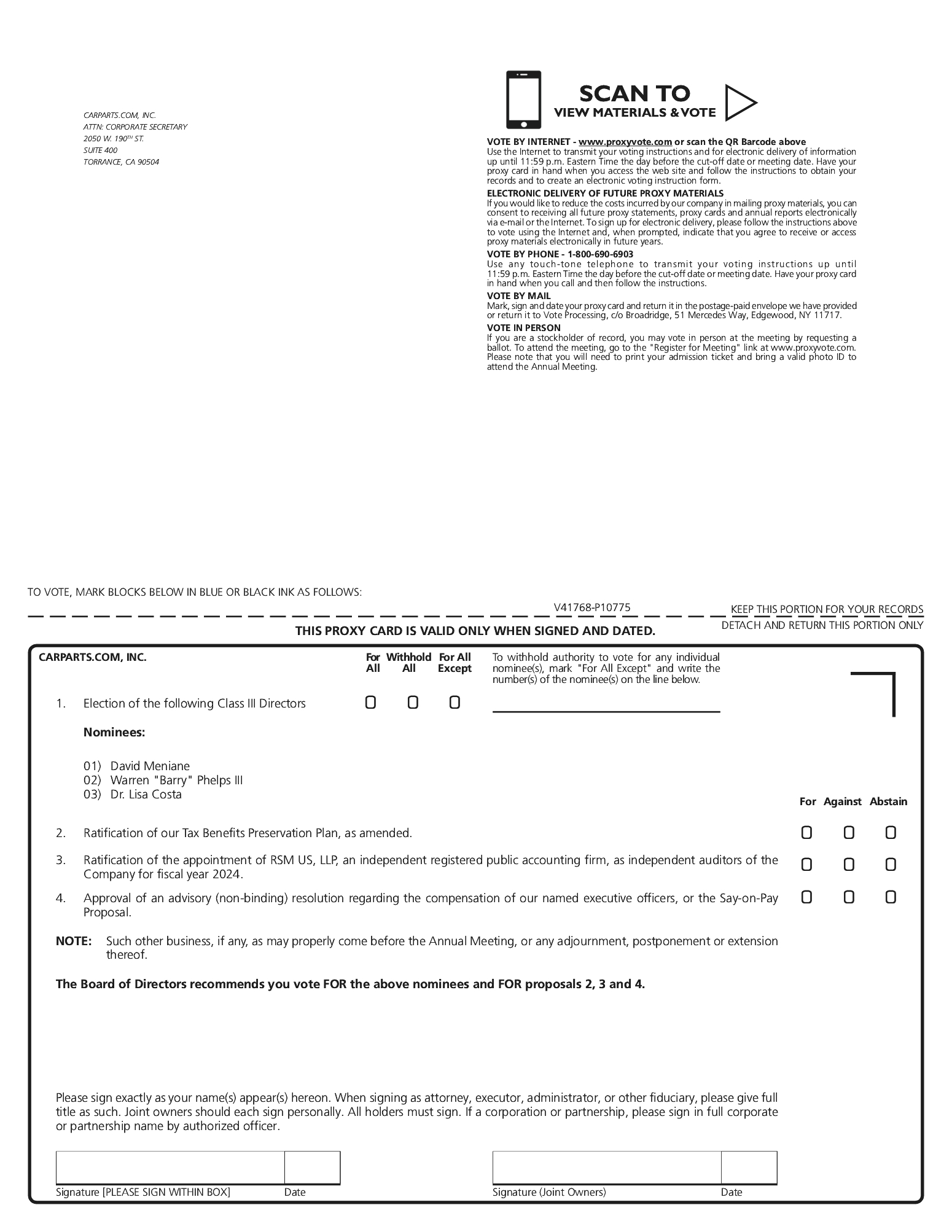

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (together with any postponements, adjournments or other delays thereof, the “Annual Meeting”) of CarParts.com, Inc., a Delaware corporation (the “Company”), will be held on May 23, 2024 at 9:00 a.m. Pacific Time at the offices of the Company located at 2050 W. 190th Street, Suite 400, Torrance, California 90504, to consider and vote on the following proposals:

1. | | | election of the following Class III directors to hold office for a term of three years and until their respective successors are elected and qualified: David Meniane, Warren “Barry” Phelps III and Dr. Lisa Costa; |

2. | | | ratification of our Tax Benefits Preservation Plan, as amended; |

3. | | | ratification of the appointment of RSM US LLP, an independent registered public accounting firm, as independent auditors of the Company for fiscal year 2024; and |

4. | | | approval of an advisory (non-binding) resolution regarding the compensation of our named executive officers, or the Say-on-Pay Proposal. |

At the Annual Meeting, we will also transact such other business, if any, as may properly come before the Annual Meeting.

Only stockholders of record at the close of business on April 4, 2024 are entitled to notice of and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our principal executive offices and at the Annual Meeting.

All stockholders are cordially invited to attend the meeting in person. If you wish to attend the meeting in person, you will need to RSVP and print your admission ticket at www.proxyvote.com. An admission ticket together with photo identification must be presented in order to be admitted to the meeting. If you hold your shares in street name and wish to vote by ballot at the Annual Meeting, you will also need to obtain and present a legal proxy entitling you to vote at the Annual Meeting from the broker, bank or other nominee that holds your shares. Please refer to page 4 of the accompanying proxy statement for further details.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 23, 2024: This proxy statement and our annual report on Form 10-K for the year ended December 30, 2023 are available at http://carparts.com/investor.

By Order of the Board of Directors

David Meniane Chief Executive Officer | | | April 24, 2024 |

CarParts.com, Inc.

2050 W. 190th Street, Suite 400

Torrance, California 90504

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. ALL STOCKHOLDERS ARE INVITED TO ATTEND THE ANNUAL MEETING IN PERSON BY REGISTERING AT PROXYVOTE.COM. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SUBMITTED YOUR PROXY OR VOTING INSTRUCTIONS. |

CARPARTS.COM, INC.

2050 W. 190th Street, Suite 400,

Torrance, California 90504

These proxy materials and the enclosed proxy card or voting instruction form are being furnished to holders of the common stock, par value $0.001 per share, of CarParts.com, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) to be voted at the 2024 Annual Meeting of Stockholders of the Company to be held on May 23, 2024 (together with any postponements, adjournments or other delays thereof, the “Annual Meeting”). The Annual Meeting will be held at 9:00 a.m. Pacific Time at the offices of the Company located at 2050 W. 190th Street, Suite 400, Torrance, California 90504. These proxy materials are expected to be mailed on or about May 2, 2024, to all stockholders entitled to vote at the Annual Meeting.

Purpose of Meeting

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and are described in more detail in this proxy statement.

Meeting Admission

To attend the Annual Meeting, you will need to bring an admission ticket and photo identification. You will need to print an admission ticket in advance by visiting www.proxyvote.com and following the instructions there. You will need the 16-digit control number to access www.proxyvote.com. You can find your control number on:

• | Your proxy card available at www.proxyvote.com or included with this proxy statement; or |

• | Your voting instruction form if you hold your shares in street name through a broker, bank or other nominee. |

If you wish to vote by ballot at the Annual Meeting and you hold your shares in street name, you will also need to obtain a legal proxy from the broker, bank or other nominee that holds your shares giving you the right to vote your shares at the Annual Meeting. You must present this legal proxy, as well as an admission ticket and valid photo identification at the entrance to the meeting.

For questions about admission to the Annual Meeting, please contact our Corporate Secretary at (424) 205-5512.

Voting; Quorum

The record date for determining those stockholders who are entitled to notice of, and to vote at, the Annual Meeting has been fixed as April 4, 2024. Only stockholders of record at the close of business on the record date are entitled to notice of and to vote at the Annual Meeting. Each share of our common stock outstanding on the record date entitles its holder to one vote on all matters presented for a stockholder vote at the Annual Meeting.

As of the record date, 56,644,740 shares of our common stock were outstanding.

The presence at the Annual Meeting, of holders of record of a majority of the voting power of our common stock issued and outstanding and entitled to vote, present in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Shares represented by proxies that reflect abstentions or “broker non-votes” will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. If a quorum is not present, the chairperson of the Annual Meeting or holders of a majority of the voting power of the stockholders present in person or by proxy may adjourn the Annual Meeting.

In the election of directors under Proposal One, the three nominees receiving the highest number of “For” votes will be elected as Class III directors. “Withhold” votes will not be counted as votes cast, and, therefore, will have no effect on the election of directors. With regard to Proposals Two, Three, and Four, to be approved, the Company must receive the affirmative vote of a majority of the

CarParts.com, Inc. 4 2024 Proxy Statement

voting power of the stockholders present in person or by proxy and entitled to vote at the Annual Meeting and on the proposal. If you “Abstain” from voting, it will have the same effect as an “Against” vote.

Most of our stockholders hold their shares as a beneficial owner through a broker, bank or other nominee rather than directly in their own name. This is often referred to as holding shares in “street name.” If you hold your shares in street name and you do not give instructions to your broker, bank or other nominee, your shares may constitute broker non-votes.

Under applicable stock exchange rules, a broker, bank or other nominee is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker, bank or other nominee is not entitled to vote shares held for a beneficial owner on “non-routine” matters. Proposals One, Two, and Four are each considered non-routine matters. Proposal Three is considered a routine matter. Broker non-votes will have no effect on the outcome of any of the proposals being considered at the Annual Meeting. We encourage you to vote your shares in connection with the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the Annual Meeting.

Revoking Proxies; Changing Voting Instructions

If you have shares for which you are the stockholder of record, you may vote those shares by proxy. You may vote by mail, internet or telephone pursuant to instructions provided on the proxy card. Additionally, shares held in your name as the stockholder of record may be voted by you by ballot at the Annual Meeting.

If you are the beneficial owner of shares held in street name, you may vote by following the voting instruction form provided to you by your broker or other nominee. If your shares are held in street name, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds the shares giving you the right to vote the shares at the Annual Meeting.

If you are a stockholder of record, you may revoke a proxy at any time before it is voted at the Annual Meeting by: (a) delivering a proxy revocation or another duly executed proxy bearing a later date to our Corporate Secretary at 2050 W. 190th Street, Suite 400, Torrance, California 90504; (b) voting again by telephone or over the internet at a later time (only your latest dated proxy will be counted); or (c) attending the Annual Meeting and voting by ballot. Attendance at the Annual Meeting will not revoke a proxy unless you actually vote by ballot at the meeting. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker or other nominee in accordance with the instructions they provided, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting by ballot.

The enclosed proxy also grants the named proxy holders discretionary authority to vote on any other business that may properly come before the Annual Meeting. We have not been notified by any stockholder of his or her intent to present any other business at the Annual Meeting.

Solicitation

We will bear the entire cost of proxy solicitation, including the costs of preparing, assembling, printing and mailing this proxy statement, the Notice, the proxy card and any additional solicitation material furnished to the stockholders. Copies of the solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, although there is no formal agreement to do so, we may reimburse such persons for their reasonable expenses in forwarding the solicitation materials to the beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by personal contact, telephone, facsimile, email or any other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. In the discretion of management, we reserve the right to retain a proxy solicitation firm to assist in the solicitation of proxies.

CarParts.com, Inc. 5 2024 Proxy Statement

Note with Respect to Forward-Looking Statements

We have made certain forward-looking statements in this proxy statement that relate to expectations concerning matters that are not historical or current facts. These statements are forward looking statements for the purposes of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933 as amended (the “Securities Act”). In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” and similar expressions intended to identify forward-looking statements. We cannot assure you that such expectations will prove to be correct. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from such expectations, and you should not place undue reliance on these forward-looking statements. All forward-looking statements attributable to us are expressly qualified in their entirety by such language. Important factors that may cause such a difference include, but are not limited to, uncertainties regarding our business, and the economy generally, competitive pressures, our dependence on search engines to attract customers, demand for the Company’s products, the online market and channel mix for aftermarket auto parts, increases in transportation, labor and commodity and component pricing that would increase the Company’s costs, the operating restrictions in our credit agreement, the weather, the impact of customs issues or delays, supply chain disruptions and any other factors discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the Risk Factors contained in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at www.carparts.com and the SEC’s website at www.sec.gov. The forward-looking statements contained herein speak only as of the date of this proxy statement. Except as required by law, we do not undertake any obligation to update any forward-looking statements contained herein, whether as a result of new information, future events or otherwise.

CarParts.com, Inc. 6 2024 Proxy Statement

Matters to be Considered at the Annual Meeting

Election of Directors

Our Second Amended and Restated Certificate of Incorporation provides for a classified board of directors consisting of three classes of directors, each serving staggered three-year terms and each as nearly equal in number as possible as determined by our Board of Directors. As a result, a portion of our Board of Directors will be elected at each annual meeting of stockholders. Ms. Liu and Mr. Maier are Class II directors whose terms expire at the 2026 Annual Meeting of Stockholders. Messrs. Greyson and Barnes and Ms. Dutra are Class I directors whose terms expire at the 2025 Annual Meeting of Stockholders. Messrs. Meniane and Phelps and Dr. Costa are Class III directors whose terms expire at the Annual Meeting.

The class whose term of office expires at the Annual Meeting currently consists of three directors. On the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors selected and approved Messrs. Meniane and Phelps and Dr. Costa as nominees for election as Class III directors at the Annual Meeting to serve for a term of three years, expiring at the 2027 Annual Meeting of Stockholders, and until their respective successors are elected and qualified or until their earlier resignation or removal. Each nominee for election is currently a member of our Board of Directors and has consented to be named as a nominee in this proxy statement and agreed to serve as a director if elected. Management has no reason to believe that any of the nominees will be unavailable to serve. In the event any of the nominees named herein is unable to serve or for good cause will not serve at the time of the Annual Meeting, the persons named on the proxy card will exercise discretionary authority to vote for a substitute nominee or the Board may determine to reduce the size of the Board. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR ALL the nominees named below.

Recommendation of Our Board of Directors

Our Board of Directors recommends a vote “FOR ALL” of the Class III Director nominees listed below. |

Information about our Directors and Nominees

We believe that our Board as a whole should encompass a range of talent, skill, diversity and expertise enabling it to provide sound guidance with respect to our operations and interests. In addition to considering a candidate’s background and accomplishments, the Nominating and Corporate Governance Committee reviews candidates in the context of the current composition of the Board and the evolving needs of our business. In accordance with the listing standards of The Nasdaq Stock Market (the “Nasdaq Rules”) we have charged our Nominating and Corporate Governance Committee with ensuring that at least a majority of the directors qualify as “independent” under the Nasdaq Rules. See “Corporate Governance - Board Committees and Meetings - Nominating and Corporate Governance Committee” for a discussion of the factors that are considered in selecting our director nominees.

CarParts.com, Inc. 7 2024 Proxy Statement

Our Board is currently comprised of eight directors. The table and narrative below sets forth information regarding each of our directors and our director nominees, including his or her age as of the date of the Annual Meeting, the year they first became directors, business experience during at least the past five years, public company boards they currently serve on or have recently served, and certain other biographical information and attributes that the Nominating and Corporate Governance Committee determined qualify them to serve as directors. The Nominating and Corporate Governance Committee believes that the director nominees and the other current directors have the following other key attributes that are important to an effective board of directors: integrity and demonstrated high ethical standards; sound judgment; analytical skills; the ability to engage management and each other in a constructive and collaborative fashion; diversity of origin, background, experience and thought; and the commitment to devote significant time and energy to serve on the Board and its committees.

| | | | | | | | | | | Committee | |||||||||||

Name | | | Age | | | Director Since | | | Current Position(s) | | | Independent | | | Audit | | | Compensation | | | Nominating and Corporate Governance |

Warren “Barry” Phelps III | | | 77 | | | 2007 | | | Chairman of the Board | | | • | | | • | | | Chair | | | |

Jim Barnes | | | 57 | | | 2019 | | | Director | | | • | | | | | • | | | ||

Dr. Lisa Costa | | | 60 | | | 2020 | | | Director | | | • | | | • | | | | | ||

Jay K. Greyson | | | 64 | | | 2014 | | | Director | | | • | | | Chair | | | • | | | |

Nanxi Liu | | | 33 | | | 2020 | | | Director | | | • | | | | | | | Chair | ||

Henry Maier | | | 70 | | | 2021 | | | Director | | | • | | | | | | | • | ||

Ana Dutra | | | 59 | | | 2022 | | | Director | | | • | | | | | | | • | ||

David Meniane | | | 41 | | | 2022 | | | Chief Executive Officer and Director | | | | | | | | | ||||

Class III Director Nominees

David Meniane Chief Executive Officer and director Age: 41 Director Since: 2022 | | | DAVID MENIANE has served as our Chief Executive Officer and director since April 2022, and served as our Chief Operating and Financial Officer from March 2019 until April 2022. He previously served as Executive Vice President of L.A. Libations, a start-up accelerator for packaged consumer goods companies in North America, from August 2016 to March 2019, and as Chief Executive Officer of Victoria’s Kitchen, a specialty beverage company, from October 2011 through its acquisition by Hispanica International, Inc. in October 2017. Prior to that, he served as Chief Financial Officer of Aflalo & Harkham Investments, a commercial real estate investment partnership. Mr. Meniane holds a bachelor’s degree in accounting and a master’s degree in taxation from the University of Southern California and is a certified C.P.A. We believe Mr. Meniane’s valuable business and leadership experience, combined with his intimate knowledge of our financial and operational status gained through his various roles at the Company, qualify Mr. Meniane to serve as a director. |

CarParts.com, Inc. 8 2024 Proxy Statement

Warren “Barry” Phelps III Executive Chairman of Empower RF Systems Age: 77 Director Since: 2007 | | | WARREN “BARRY” PHELPS III has been a director since September 2007 and Chairman of the Board since August 2017. Since January 2013, he has served as Executive Chairman of Empower RF Systems, a developer and manufacturer of high power RF amplifiers for the defense and commercial markets. Mr. Phelps joined the Board of Empower in February 2007, and served as its Chairman and CEO from October 2009 to January 2013. Since May of 2017, Mr. Phelps has also served on the Board of Luna Innovations, a developer and manufacturer of high-speed optical test products for the commercial and defense markets. From 2000 until his retirement in September 2006, Mr. Phelps served in several executive positions for Spirent Communications plc, a leading communications technology company, most recently as President of the Performance Analysis-Broadband Division. From 1996 to 2000, Mr. Phelps was at Netcom Systems, a provider of network test and measurement equipment, most recently as President and Chief Executive Officer. Prior to that, Mr. Phelps held executive positions, including Chairman and Chief Executive Officer at MICOM Communications, and various financial management roles at Burroughs/Unisys Corporation. He also served on the Board of Trustees of St. Lawrence University. Mr. Phelps holds a B.S. degree in mathematics from St. Lawrence University in Canton, New York and an M.B.A. from The University of Rochester in Rochester, New York. We believe that Mr. Phelps is qualified to serve as a director due to his financial background as well as his executive management experience across numerous technology companies. Audit Compensation (Chair) |

Dr. Lisa Costa Chief Technology and Innovation Officer Age: 60 Director Since: 2020 | | | DR. LISA COSTA has been a director since November 2020. Since 2018, she has been a member of the US Government Senior Executive Service. She serves as the Chief Technology and Innovation Officer (CTIO) for the US Space Force. As such she is the most senior cyber civilian of the Service and leads the work for the Service in artificial intelligence (AI), data, communications networking, Modeling Simulation & Analyses, Futures, and Energy. Previously she was CIO for USSOCOM – where she oversaw a $1.3 billion annual IT budget and network and cyber operations that included cloud infrastructure, secure mobility, satellite and terrestrial communications, and DevSecOps agile software development supporting AI. Dr. Costa was a member of multiple Defense Science Boards, invented numerous systems and algorithms, and has advised Presidential Transition Teams on national security issues. She served on the board of Hire Our Heroes and has advised Fortune 500 companies, including Target, Hilton, Starbucks, Cheniere, and FedEx on enterprise risk management. Previously Dr. Costa served as a director at the MITRE Corporation and was Vice President and Chief Scientist at Planet Risk, Inc. from 2017 to 2018. She is an honoree of the James Schlesinger Award for Service to Our Nation and has been awarded the Joint Chiefs of Staff Joint Meritorious Civilian Service Medal. Dr. Costa holds Bachelor of Science degrees in Computer Science and Mathematics from Rollins College, an MBA from Tampa College, and a PhD in Computer Science from Union Institute. We believe that Dr. Costa is qualified to serve as a director due to her cybersecurity, network operations, and data analytics expertise and her deep understanding of business, technology, and eCommerce, as well as her experience in advising Fortune 500 companies. Audit |

CarParts.com, Inc. 9 2024 Proxy Statement

Directors Whose Terms Continue

Class I Directors - Terms Expiring at the 2025 Annual Meeting of Stockholders

Jay K. Greyson Partner, Managing Director, and Principal of Supply Chain Equity Partners Age: 64 Director Since: 2014 | | | JAY K. GREYSON has been a director since June 2014. He is a Partner, Managing Director, and Principal of Supply Chain Equity Partners, a committed capital private equity fund dedicated exclusively to the distribution and supply chain industry which he co-founded in 2006. Jay serves as the Non-Executive Chairman of Supply Chain Equity's portfolio companies and leads the development of strategic & tactical planning and execution initiatives. Before co-founding Supply Chain Equity Partners, Jay was a Founding Partner and the Chief Compliance Officer of Vetus Partners, an investment bank specializing in domestic and cross-border mergers, acquisitions and corporate divestitures of middle market businesses, and established and led practice groups at Brown Gibbons Lang & Company, a regional investment banking firm. Over his career, Jay has held various operating company roles, including General Manager, National Sales Manager, Product Manager, and Marketing Manager, as well as having served on a number of boards. Jay holds a B.S.E.E. degree from the University of Virginia, an M.B.A. from the University of Chicago, is recognized by the National Association of Corporate Directors (NACD) as NACD Directorship Certified, and has completed his CERT Certification in Cybersecurity Oversight. We believe that Mr. Greyson is qualified to serve as a director due to his leadership experience in private equity and investment banking, combined with his financial background and management experience in manufacturing, distribution and supply chain. Audit (Chair) Compensation |

Jim Barnes CEO of enVista, LLC, a supply chain and unified commerce consulting firm Age: 57 Director Since: 2019 | | | JIM BARNES has been a director since October 2019. From 2002 to 2022, Mr. Barnes served as the CEO of enVista, LLC, a supply chain and unified commerce consulting firm, which he co-founded. Prior to founding enVista, he was the Executive Vice President and co-founder of Q4 Logistics. Mr. Barnes has over 30 years, designing, implementing and managing supply chain solutions for Fortune 500 companies, and consults for a number of automotive parts manufacturers, distributors and retailers. Mr. Barnes holds a B.S. degree in Mechanical Engineering Technology from Purdue University. We believe Mr. Barnes extensive subject matter expertise with respect to supply planning, supply chain execution and commerce platforms qualify him to serve as a director. Compensation |

CarParts.com, Inc. 10 2024 Proxy Statement

Ana Dutra Board of the Latino Corporate Directors Association and chairs its Educational Foundation Board Age: 59 Director Since: 2022 | | | ANA DUTRA has been a director since January 2022. She serves on the Board of the Latino Corporate Directors Association and chairs its Educational Foundation Board, and Pembina Pipeline (NYSE: PBA). Previously, she served as a member of the Board of Directors of First Internet Bancorp (Nasdaq: INBK), CME Group Inc. (Nasdaq:CME), Amyris (Nasdaq: AMRS) and Harvest Inc. (NCSX:HARV). Before that, she was the CEO of The Executives’ Club of Chicago from 2014 until 2018 and of Korn/Ferry Consulting from 2007 until 2013. Ana holds an M.B.A. from Kellogg at Northwestern University, a Masters in Economics from Pontificia Universidade do Rio de Janeiro, and a Juris Doctor from Federal Universidade of Rio de Janeiro. She is a faculty member of NACD and holds a NACD Directorship Certification, a CERT Certification in Cybersecurity Oversight by Carnegie Mellon University and Diligent ESG and Climate Leadership Certification. We believe Ms. Dutra’s extensive experience assisting boards of directors, CEOs and management teams to identify and execute growth strategies through innovation, acquisitions, and new technologies and to pursue their corporate governance objectives qualify her to serve as a director. Nominating and Corporate Governance |

Class II Directors - Terms Expiring at the 2026 Annual Meeting of Stockholders

Nanxi Liu Co-CEO and Co-Founder of Blaze Technology, Inc., CFO and Co-Founder of Nanoly Bioscience, Inc., Age: 33 Director Since: 2020 | | | NANXI LIU has been a director since July 2020. She serves as the Co-CEO and Co-Founder of Blaze Technology, Inc., an AI-powered no-code software platform. Nanxi also serves on the Board of Directors of Proeza Group, a conglomerate, and is a Partner at XFactor Ventures, where she invests in women-founded startups. She previously served on the Boards of Directors of Carlotz (Nasdaq:LOTZ) prior to its acquisition by Shift Technologies in 2022, and Kindred Biosciences (Nasdaq: KIN), prior to its acquisition by Elanco (NYSE: ELAN) in 2021. She also served on the Board of Directors for California Department of Motor Vehicles’ New Motor Vehicle Board. Ms. Liu holds a Bachelor of Science degree in Business Administration and a Bachelor of Arts degree in Political Economy from the University of California, Berkeley. We believe that Ms. Liu’s extensive experience in running and advising technology companies qualify her to serve as a director. COMMITTEES: Nominating and Corporate Governance (Chair) |

CarParts.com, Inc. 11 2024 Proxy Statement

Henry J. Maier President and Chief Executive Officer of FedEx Ground, a subsidiary of FedEx Corp. Age: 70 Director Since: 2021 | | | HENRY J. MAIER has been a director since April 2021. From 2013 until his retirement on July 31, 2021, Henry was President and Chief Executive Officer of FedEx Ground, a subsidiary of FedEx Corp. Prior to serving as President and Chief Executive Officer, Mr. Maier was an executive vice president of FedEx Ground and responsible for all the company’s strategic planning, contractor relations and corporate communications programs. Mr. Maier has over 40 years of experience in the transportation industry, including more than 35 years at FedEx companies. He currently serves as a director on the boards and various committees of CalAmp Corp. (Nasdaq: CAMP), CH Robinson, Inc. (Nasdaq:CHRW) and Kansas City Southern (NYSE: KSU), a transportation holding company. Mr. Maier previously served on the Strategic Management Committee of FedEx Corp. (NYSE: FDX), which set the strategic direction for the FedEx enterprise. Mr. Maier receive a Bachelor of Arts degree in Economics from the University of Michigan. We believe Henry is qualified to serve on the Board due to his extensive executive leadership skills and experience within the logistics and transportation industry, which will strengthen the Board’s ability to oversee the execution of our Company’s strategy. Nominating and Corporate Governance |

Family Relationships

There are no family relationships among any of our directors, executive officers and director nominees.

CarParts.com, Inc. 12 2024 Proxy Statement

Code of Ethics and Business Conduct

Our Board of Directors has adopted a Code of Ethics and Business Conduct which applies to all directors, officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and employees. The full text of our Code of Ethics and Business Conduct can be directly accessed at https://www.carparts.com/investor/corporate-governance. We intend to disclose future amendments to certain provisions of the Code of Ethics and Business Conduct and any waivers of provisions of the Code of Ethics and Business Conduct required to be disclosed under the rules of the SEC or the Nasdaq Rules, at the same location on our website. The information contained in, or that can be accessed through, our website does not constitute a part of this proxy statement.

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines, which provide the framework for our corporate governance along with our Second Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws (the “Bylaws”), committee charters and other key governance practices and policies. Our corporate governance guidelines cover a wide range of subjects, including the conduct of board meetings, independence and selection of directors, and director ownership guidelines. The corporate governance guidelines can be accessed on our website at https://www.carparts.com/investor/corporate-governance.

The Board may periodically engage an independent third-party advisor experienced in corporate governance matters to facilitate, and bring an outside perspective to, the Board’s annual self-assessment process. The Board engaged such an advisor in 2023. During 2023, the advisor conducted one-on-one, open-ended interviews with all Board members to provide each director with the opportunity to openly discuss the performance and effectiveness of the Board as a whole and its committees. The interviews also provided each director with an opportunity to identify areas for the Board to improve its effectiveness. In addition to the director interviews, the advisor conducted interviews with members of senior management who regularly attend Board meetings to solicit their perspectives on the relationship between the Board and management. The advisor’s process was developed in consultation with the Chairman of the Board and the Chair of the Nominating and Governance Committee, as well as our CEO and our General Counsel. The advisor gathered and analyzed the data and presented its findings and recommendations to the full Board.

Director Independence

The Board reviewed the independence of each of our directors on the basis of the standards adopted by the Nasdaq Stock Market (“Nasdaq”). During this review, the Board considered transactions and relationships between the Company, on the one hand, and each director, members of his or her immediate family, and other entities with which he or she is affiliated, on the other hand. The purpose of this review was to determine which of such transactions or relationships were inconsistent with a determination that the director is independent under the Nasdaq Rules. After the review, the Board of Directors determined that each of our directors with the exception of Mr. Meniane satisfies the requirements for “independence” under the listing standards of the Nasdaq Rules. In making its determination regarding the independence of Mr. Maier, the Board considered the fact that Mr. Maier previously served as president and CEO of FedEx Ground and payments made by the Company in the ordinary course to FedEx Ground for shipping and carrier services at market rates and terms which payments represented less than 1% of the total revenue of each of FedEx Ground and its parent FedEx Corporation. Mr. Maier retired from his position at FedEx Ground effective July 31, 2021.

Board Leadership Structure

The Board has maintained a separation between the seats of Chairman and Chief Executive Officer since the Company went public in 2007 in recognition of the different demands and responsibilities of the roles and to emphasize the independence of the role of Chairman. The separate roles allow us to have a Chairman focused on the leadership of the Board, providing our Chief Executive Officer with the ability to focus more of his time and energy on managing our operations. The Board also meets regularly in executive session without the presence of management.

CarParts.com, Inc. 13 2024 Proxy Statement

Board Oversight of Risk

The Board is responsible for overseeing our risk management but its duties in this regard are aided by the Audit Committee, which is responsible for discussing with management and our independent auditors policies with respect to risk assessment and risk management, including the process by which we undertake major financial and accounting risk assessment and management. The Audit Committee also oversees our corporate compliance programs, as well as the internal audit function. In addition to the Audit Committee’s work in overseeing risk management, our full Board periodically engages in discussions of the most significant risks that the Company is facing and how these risks are being managed, and the Board receives reports on risk management from senior officers of the Company and from the Compensation Committee, and the Nominating and Corporate Governance Committee. The Audit Committee meets privately with our management team in order to assess the overall control environment and “tone at the top” and to provide the Audit Committee with direct feedback as to any control or oversight issues. Other committees, including the Compensation Committee and the Nominating and Corporate Governance Committee, review risks relevant to their particular areas of responsibility. These matters are reviewed at Board meetings as well and, if deemed necessary and appropriate, in executive session with only the independent directors present. Our management team has the primary responsibility for identifying and managing the known, material risks which could affect our operating and financial performance. Periodically, the management team reviews with the full Board the key risks facing the Company, the Compensation Committee, and the Nominating and Corporate Governance and the plans the Company has put in place to mitigate those risks. Our management team also reviews subsets of risk on a more frequent basis with the Board.

Our Board believes that the process it has established to administer the Board’s risk oversight function would be effective under a variety of leadership frameworks and, therefore, does not have a material effect on our choice of the Board’s leadership structure described above under “Board Leadership Structure.”

Board Committees and Meetings

Our Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each committee has a written charter that is reviewed annually and revised as appropriate. A copy of each committee’s charter is available on the Investor Relations section of our website at www.carparts.com.

During fiscal 2023, the Board of Directors and the various committees of the Board held the following number of meetings: Board of Directors – 11; Audit Committee – 4; Compensation Committee – 8; and Nominating and Corporate Governance Committee – 6. All directors attended at least 75% of the aggregate number of meetings of the Board of Directors and the committees on which they served during the period in which they served in 2023. We do not have a formal policy regarding attendance by members of our Board of Directors at annual meetings of stockholders; however, directors are encouraged to attend all such meetings. All of our then-serving directors attended our 2023 Annual Meeting of Stockholders in person or via video conference.

Audit Committee. Our Audit Committee consists of Messrs. Greyson and Phelps and Dr. Costa. Mr. Greyson is the Chairman of the Audit Committee. Our Board of Directors has determined that each member of the Audit Committee is independent under the Nasdaq Rules and Rule 10A-3 under the Exchange Act. In addition, our Board of Directors has determined that each of Messrs. Greyson and Phelps qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC. The primary functions of this committee include the following:

• | meeting with our management periodically to consider the adequacy of our internal controls and the objectivity of our financial reporting; |

• | meeting with our independent auditors and with internal financial personnel regarding these matters; |

• | pre-approving audit and non-audit services to be rendered by our independent auditors; |

• | appointing from time to time, engaging, determining the compensation of, evaluating, providing oversight of the work of and, when appropriate, replacing our independent auditors; |

• | reviewing our financial statements and periodic reports and discussing the statements and reports with our management and independent auditors, including any significant adjustments, management judgments and estimates, new accounting policies and disagreements with management; |

• | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls and auditing matters; |

CarParts.com, Inc. 14 2024 Proxy Statement

• | reviewing our financing plans and reporting recommendations to our full Board of Directors for approval and to authorize action; and |

• | administering and discussing with management and our independent auditors our Code of Ethics and Business Conduct. |

Our internal financial personnel regularly meet privately with the Audit Committee and have unrestricted access to this committee. Our independent auditors report directly to the Audit Committee and they also have unrestricted access to this committee.

Compensation Committee. Our Compensation Committee consists of Messrs. Phelps, Barnes and Greyson. Mr. Phelps is the Chairman of our Compensation Committee. Our Board of Directors has determined that each member of the Compensation Committee is independent under the Nasdaq Rules. The primary functions of this committee include the following:

• | determining the compensation and other terms of employment of our executive officers and senior management, and reviewing and approving corporate performance goals and objectives relevant to such compensation; |

• | recommending to our Board of Directors the type and amount of compensation to be paid or awarded to members of our Board of Directors; |

• | evaluating and recommending to our Board of Directors the equity incentive plans, compensation plans and similar programs advisable for us, as well as modification or termination of existing plans and programs; |

• | administering the issuance of stock options and other equity incentive arrangements under our equity incentive plans; and |

• | reviewing and approving the terms of employment agreements, severance arrangements, change-in-control protections and any other compensatory arrangements for our executive officers and senior management. |

A more detailed description of the role of the Compensation Committee, including the role of executive officers and consultants in compensation decisions, can be found under “Executive Compensation and Other Information” below.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of Mses. Liu and Dutra, and Mr. Maier. Ms. Liu is the Chair of our Nominating and Corporate Governance Committee. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent under the Nasdaq Rules. The primary functions of this committee include the following:

• | identifying qualified candidates to become members of our Board of Directors; |

• | selecting nominees for election of directors at the next annual meeting of stockholders (or special meeting of stockholders at which directors are to be elected); |

• | selecting candidates to fill vacancies of our Board of Directors; and |

• | overseeing the evaluation of our Board of Directors. |

The Nominating and Corporate Governance Committee generally seeks directors with strong reputations and experience in areas relevant to the operations and strategies of the Company’s business. In connection with their recommendations regarding the size and composition of the Board, the Nominating and Corporate Governance Committee reviews the appropriate qualities and skills required of directors in the context of the then current make-up of the Board and the needs of the Company. The Nominating and Corporate Governance Committee generally identifies candidates for election to the Board of Directors; reviews their skills, characteristics and experiences; and recommends director nominees to the Board for approval. While we do not have a formal policy with regard to the consideration of diversity in identifying director nominees, the Company is taking active steps to comply with applicable legislation relating to Board diversity requirements. The Nominating and Corporate Governance Committee strives to nominate directors with a variety of complementary skills and backgrounds so that, as a group, the Board will possess the appropriate talent, skills, insight and expertise to oversee our business. The Nominating and Corporate Governance Committee assesses each candidate’s independence, personal and professional integrity, financial literacy or other professional or business experience relevant to an understanding of our business; his or her ability to think and act independently and with sound judgment; and his or her ability and commitment to serve our and our stockholders’ long-term interests. All factors considered by the Nominating and Corporate Governance Committee are reviewed in the context of an assessment of the perceived needs of the

CarParts.com, Inc. 15 2024 Proxy Statement

Board at a particular point in time. As a result, the priorities and emphasis of the Nominating and Corporate Governance Committee and of the Board may change from time to time to take into account changes in our business, our future opportunities and strategic plans, and other trends, as well as the portfolio of skills and experience of current and prospective directors.

The Nominating and Corporate Governance Committee generally leads the search for and selects, or recommends that the Board select, candidates for election to the Board. Consideration of new director candidates typically involves a series of committee discussions, a review of information concerning candidates and interviews with selected candidates. The Nominating and Corporate Governance Committee may in the future engage the services of a third-party search firm to identify director candidates. The Nominating and Corporate Governance Committee has the discretion to decide which individuals to recommend for nomination as directors.

The Nominating and Corporate Governance Committee will consider candidates for director recommended by our stockholders who meet the eligibility requirements for submitting stockholder proposals pursuant to Rule 14a-8 for inclusion in our next proxy statement. The Nominating and Corporate Governance Committee will evaluate such recommendations applying its regular nominee criteria. Eligible stockholders wishing to recommend a director nominee must submit such recommendation in writing to the Chair, Nominating and Corporate Governance Committee, care of the Corporate Secretary, at the Company’s address set forth on the first page of this proxy statement by the deadline for submitting stockholder proposals pursuant to Rule 14a-8 or our Bylaws for inclusion in our next proxy statement set forth under “Additional Information” below. Nominations in accordance with our Bylaws must specify the following information: (a) the name and address of the candidate, (b) the name, address and phone number of the stockholder making the recommendation and of the director candidate, (c) the director candidate’s qualifications for membership on the Board, (d) a resume of the candidate’s business experience and educational background as well as all of the information that would be required in a proxy statement soliciting proxies for the election of the candidate as a director if nominated by the Board, (e) a description of all direct or indirect arrangements or understandings between the recommending stockholder and the candidate and any other person or persons (naming such person or persons) pursuant to whose request the recommendation is being made by the stockholder, (f) all other companies to which the candidate is being recommended as a candidate for director, and (g) a signed consent of the candidate to cooperate with reasonable background checks and personal interviews, and to serve as a director, if nominated and elected. In connection with its evaluation, the Nominating and Corporate Governance Committee may request additional information from the candidate or the recommending stockholder, and may request an interview with the candidate.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has been an officer or employee of our Company or has had any relationship requiring disclosure under Item 404 of Regulation S-K during the last fiscal year. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee.

Voting Agreements with Stockholders

None

Stockholder Communications to the Board

Our Board of Directors has implemented a process by which stockholders may send written communications directly to the attention of the Board, any committee of the Board or any individual Board member, care of our Corporate Secretary at 2050 W. 190th Street, Suite 400, Torrance, California 90504. The name of any specific intended Board recipient should be noted in the communication. Our Corporate Secretary will be primarily responsible for collecting, organizing and monitoring communications from stockholders and, where appropriate depending on the facts and circumstances outlined in the communication, providing copies of such communications to the intended recipients. Communications will be forwarded to directors if they relate to appropriate and substantive corporate or Board matters. Communications that are of a commercial or frivolous nature, or otherwise inappropriate for the Board’s consideration will not be forwarded to the Board.

CarParts.com, Inc. 16 2024 Proxy Statement

Policy on Stock Hedging

All directors and executive officers are prohibited from engaging in short-term or speculative transactions involving our securities, such as publicly t-aded options, short sales, puts and calls, and hedging transactions.

Environmental, Social, Governance (“ESG”) Oversight

We are committed to conducting business in an environmentally sustainable and socially responsible manner and managing the risks and opportunities that arise from ESG issues. We believe that operating in a socially responsible and sustainable manner will drive long-term value creation for our Company and its stockholders.

The Nominating and Corporate Governance Committee is responsible for overseeing the Company's ESG processes, policies, and performance and making recommendations to the full Board. The Nominating and Corporate Governance Committee will receive regular updates from management on progress and strategy to satisfy these oversight responsibilities. The Audit Committee oversees additional risk management functions, including cybersecurity risks.

In 2021, the Company launched a new initiative to enhance our ESG policies and disclosures informed by the Sustainability Accounting Standards Board (“SASB”) e-commerce industry disclosure guidelines. In 2022, our management reviewed and updated various ESG policies and processes located on the investor relations page of our website at https://www.carparts.com/ESG/. The enhanced policies included: Environmental, Data Privacy, Human Rights, Labor Rights, Whistleblower, and Political Involvement.

In 2022, the Company published its first Corporate Social Responsibility Report (“CSR Report”), located at https://www.carparts.com/ESG/. The CSR Report incorporates the Company’s SASB report, which aligned with the standards for the e-commerce industry includes quantitative data, discussion of data privacy and security, and analysis of the Company’s environmental considerations.

We aim to build upon ESG progress made thus far and continue to develop our long-term ESG roadmap.

Diversity and Inclusion

We work to enable our employees to think creatively and authentically, share their ideas, bring their whole selves to work, and strive to make a difference every day. We are proud to have a diverse team, and we recognize that there is opportunity for us to continue improving representation, particularly among our senior leadership. We support and celebrate all diversity, and are committed to providing an equal employment opportunity regardless of race, color, ancestry, religion, sex, national origin, sexual orientation, age, marital status, disability, gender identity, or Veteran status. Below is a breakdown of how our team self-identifies as of December 30, 2023:

Category | | | All | | | Corporate | | | Management | | | Executives | | | Board |

Black | | | 22% | | | 4% | | | 11% | | | — | | | — |

Hispanic/Latinx | | | 16% | | | 17% | | | 14% | | | 33.4% | | | 12.5% |

Asian | | | 42% | | | 41% | | | 35% | | | 33.3% | | | 12.5% |

White | | | 18% | | | 35% | | | 36% | | | 33.3% | | | 75% |

Female | | | 39% | | | 39% | | | 32% | | | 16.7% | | | 37.5% |

In addition, our Board of Directors believes that in order to fulfill its overall fiduciary responsibility to stockholders and the Company, it must maintain a strategic composition that includes the experience, qualifications, skills, and diversity needed for each member of the Board of Directors to complement the others. When searching for new directors, the Board of Directors actively seeks to maintain its diversity. During 2023 and as of March 19, 2024, three of our eight board members were female, and two of our eight members represented a minority group.

CarParts.com, Inc. 17 2024 Proxy Statement

Board Diversity

The Board believes that it should seek diversity in experience and viewpoint to be represented on the Board. In selecting a director nominee, the Nominating and Governance Committee focuses on a combination of skills, professional expertise, background, and diverse viewpoints that would complement the existing Board.

Board Diversity Matrix (as of 3-19-2024)

Board Size: | ||||||||||||

Total Number of Directors | | | 8 | |||||||||

Gender: | | | Male | | | Female | | | Non-Binary | | | Undisclosed |

Directors | | | 5 | | | 3 | | | 0 | | | 0 |

Number of directors who identify in any of the categories below: | | | | | | | | | ||||

African American or Black | | | 0 | | | 0 | | | 0 | | | 0 |

Alaskan Native or American Indian | | | 0 | | | 0 | | | 0 | | | 0 |

Asian (other than South Asian) | | | 0 | | | 1 | | | 0 | | | 0 |

South Asian | | | 0 | | | 0 | | | 0 | | | 0 |

Hispanic or Latinx | | | 0 | | | 1 | | | 0 | | | 0 |

Native Hawaiian or Pacific Islander | | | 0 | | | 0 | | | 0 | | | 0 |

White | | | 5 | | | 1 | | | 0 | | | 0 |

Two or More Races or Ethnicities | | | 0 | | | 0 | | | 0 | | | 0 |

LGBTQ+ | | | 0 | |||||||||

Did Not Disclose Demographic Background | | | 0 | |||||||||

Directors with Disabilities | | | 0 | |||||||||

CarParts.com, Inc. 18 2024 Proxy Statement

Ratification of Tax Benefits Preservation Plan

You are being asked to ratify the adoption by our Board of the Tax Benefits Preservation Plan (as amended, the “Tax Plan”), dated as of April 5, 2024, by and between the Company and Computershare Trust Company, N.A., as rights agent. A summary of the Tax Plan appears below and is qualified by the full text of the Tax Plan attached as Appendix B to this Proxy Statement.

Background of the Proposal

On April 5, 2024, we entered into the Tax Plan between us and Computershare Trust Company, N.A., as rights agent. The Tax Plan is designed to preserve the availability of our existing net operating loss carryforwards and other tax attributes (collectively, the “Tax Assets”). In adopting the Tax Plan, the Board of Directors concluded that it is in the best interests of the Company and our stockholders that the Company provide for the preservation of our Tax Assets by adopting the Tax Plan.

While stockholder ratification of the Tax Plan is not required under Delaware law, our Board of Directors has determined to seek stockholder ratification of the Tax Plan in furtherance of good corporate governance. The Rights issued pursuant to the Tax Plan will expire upon the earliest of: (i) the close of business on the third anniversary of the adoption of the Plan (the “Final Expiration Date”); (ii) the close of business on the first anniversary of the date of the adoption of the Tax Plan if stockholder approval of the Tax Plan is not obtained prior to such date; (iii) the time at which the Rights are redeemed pursuant to the Tax Plan, (iv) the time at which the Rights are exchanged pursuant to the Tax Plan; (v) the closing of any merger or other acquisition transaction involving the Company pursuant to an agreement approved by the Board; (vi) the close of business on the effective date of the repeal of Section 382 of the Code if the Board determines that the Tax Plan is no longer necessary or desirable for the preservation of the Tax Attributes (as defined in the Tax Plan); or (vii) the close of business on the first day of a taxable year of the Company to which the Board determines that no Tax Attributes may be carried forward or otherwise utilized

The Tax Benefits Preservation Plan

The Tax Plan is intended to help protect the Company’s Tax Assets. Through year-end 2023, the Company has U.S. federal net operating loss carryforwards of approximately $105 million as well as other tax attributes that could potentially be used to offset the Company’s future U.S. federal income tax expense. We can utilize the Tax Assets in certain circumstances to offset taxable income and reduce our federal income tax liability. Our ability to use the Tax Assets would be substantially limited if there were an “ownership change” as defined under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), and the Internal Revenue Service rules.

The Board of Directors adopted the Tax Plan to reduce the risk that our ability to use our Tax Assets would be substantially limited following an “ownership change” under Section 382 of the Code. The Tax Plan deters any person or group from becoming or obtaining the right to become a “5-percent shareholder” (as such term is used in Section 382 of the Code) or, in certain cases, from increasing such person’s or group’s ownership of shares of the Company’s common stock beyond 4.99%, in each case, without first obtaining the approval of the Board of Directors. In general, an ownership change would occur if the Company’s “5-percent shareholders” collectively increase their ownership in the Company by more than 50 percentage points over a rolling three-year period. While the Board of Directors adopted the Tax Plan to diminish the risk that the Company’s ability to use our Tax Assets would be substantially impaired, nonetheless, the Tax Plan may also have an “anti-takeover effect” because it may deter or discourage a person or group from acquiring beneficial ownership of 4.99% or more of the shares of common stock or, in the case of a person or group that already own 4.99% or more of the shares of common stock, from acquiring any additional shares without advance approval from the Board of Directors. Subject to certain exceptions, if any person or group acquires 4.99% or more of the outstanding shares of common stock without approval of the Board of Directors, there would be a triggering event under the Tax Plan that could result in significant dilution in the ownership interest of such person or group. As such, the Tax Plan has anti-takeover effects.

CarParts.com, Inc. 19 2024 Proxy Statement

The description of the Tax Plan contained in this Proposal Two is qualified in its entirety by reference to the text of the Tax Plan which is attached hereto as Appendix B. You are urged to carefully read the Tax Plan in its entirety as the discussion herein is only a summary.

The Rights. On April 4, 2024, the Board of Directors declared a dividend of one preferred share purchase right (a “Right”) for each outstanding share of common stock. Rights were issued to the stockholders of record as of the close of business on April 16, 2024 (the “Tax Plan Record Date”). Each Right, upon becoming exercisable, entitles the registered holder to purchase from the Company one one-thousandth of a share of Series B Junior Participating Preferred Stock (the “Series B Preferred Stock”), par value $0.001 per share, of the Company at a price of $11.13 per one one-thousandth of a share of Series B Preferred Stock (the “Purchase Price”), subject to adjustment and to the other terms, provisions and conditions of the Tax Plan.

The description and terms of the Rights are set forth in the Tax Plan. Until it is exercised or exchanged, a Right does not give its holder any rights as a stockholder of the Company, including without limitation any dividend, voting or liquidation rights, powers or preferences.

Series B Preferred Stock. Each share of Series B Preferred Stock will be entitled, when, as and if declared, to a minimum preferential quarterly dividend payment of an amount equal to the greater of (a) $10.00 per share and (b) 1,000 times the dividend declared per share of common stock, subject to adjustment. In the event of liquidation, dissolution or winding up of the Company, the holders of the Series B Preferred Stock will be entitled to a minimum preferential liquidation payment of the greater of (a) $10.00 per share (plus any accrued but unpaid dividends), and (b) an amount equal to 1,000 times the payment made per share of common stock. Each share of Series B Preferred Stock will have 1,000 votes, voting together with the common stock. Finally, in the event of any merger, consolidation or other transaction in which outstanding shares of common stock are converted or exchanged, each share of Series B Preferred Stock will be entitled to receive 1,000 times the amount received per share of common stock. These rights are protected by customary antidilution provisions. Shares of Series B Preferred Stock purchasable upon exercise of the Rights will not be redeemable.

Because of the nature of the Series B Preferred Stock’s dividend, liquidation and voting rights, the value of the one one-thousandth interest in a share of Series B Preferred Stock purchasable upon exercise of each Right should approximate the value of one share of common stock.

Exercisability. The Rights will not be exercisable until the earlier of (i) ten (10) business days following a public announcement that a person or group (an “Acquiring Person”) has acquired beneficial ownership of 4.99% or more of the shares of common stock then outstanding or any existing 4.99% or greater holder has acquired one or more additional shares of common stock (except in certain situations) or (ii) ten (10) business days after the date of commencement of a tender offer or exchange offer the consummation of which would result in the beneficial ownership by a person or group of 4.99% or more of the then-outstanding shares of common stock (the earlier of such dates called the “Distribution Date”). Until the Distribution Date, the Rights will be evidenced, with respect to any of the common stock certificates (or book entry shares in respect of the common stock) outstanding as of the Tax Plan Record Date, by such common stock certificate (or such book entry shares) together with a notation to that effect.

Until the Distribution Date, the Rights will be transferred only with the common stock. Until the Distribution Date, new common stock certificates (or book entry shares in respect of the common stock) issued after the Tax Plan Record Date upon transfer or new issuances of common stock, as applicable, will contain a notation incorporating the Tax Plan by reference and, with respect to any uncertificated book entry shares issued after the Tax Plan Record Date, proper notice will be provided that incorporates the Tax Plan by reference.

In the event that a person or group becomes an Acquiring Person, each holder of a Right, other than Rights beneficially owned by the Acquiring Person (which will thereupon become void), will thereafter have the right to receive upon exercise of a Right and payment of the Purchase Price, that number of shares of common stock having a market value of two times the Purchase Price.

Exchange. At any time after any person or group becomes an Acquiring Person and prior to the acquisition by such person or group of 50% or more of the voting power of the outstanding shares of common stock, the Board of Directors may exchange the Rights (other than Rights owned by such person or group, which will have become void), in whole or in part, for shares of common stock, at an exchange ratio of one share of common stock per Right (subject to adjustment).

CarParts.com, Inc. 20 2024 Proxy Statement

Expiration. Pursuant to the Tax Plan, the Rights will expire upon the earliest to occur of the following:

• | the close of business on April 5, 2027; |

• | the close of business on the first anniversary of the date of the adoption of the Tax Plan if stockholder approval of the Tax Plan is not obtained prior to such date; |

• | the time at which the Rights are redeemed or exchanged under the Tax Plan; |

• | the closing of any merger or other acquisition transaction involving the Company pursuant to an agreement of the type described in the Tax Plan; |

• | the repeal of Section 382 of the Code or any successor statute if the Board of Directors determines that the Tax Plan is no longer necessary for the preservation of the Company’s Tax Attributes; or |

• | the beginning of a taxable year of the Company to which the Board of Directors determines that no Tax Attributes may be carried forward. |

Anti-Dilution Provisions. The Purchase Price payable, and the number of shares of Series B Preferred Stock issuable, upon exercise of the Rights are subject to adjustment from time to time to prevent dilution (i) in the event of a stock dividend on, or a reclassification, subdivision or combination of, the Series B Preferred Stock; (ii) upon the grant to holders of the Series B Preferred Stock of certain rights or warrants to subscribe for or purchase Series B Preferred Stock at a price, or securities convertible into Series B Preferred Stock with a conversion price, less than the then-current market price of the Series B Preferred Stock; or (iii) upon the distribution to holders of the Series B Preferred Stock of evidences of indebtedness or assets (excluding regular periodic cash dividends or dividends payable in Series B Preferred Stock) or of subscription rights or warrants. No adjustments to the Purchase Price of less than 1% will be made. The Rights are also subject to adjustment in the event of a stock dividend on the common stock payable in shares of common stock, or subdivisions, consolidation or combinations of the common stock occurring, in any such case, prior to the Distribution Date.

Redemption. The Board of Directors may, at any time prior to a Trigger Event, as defined in the Tax Plan, redeem the Rights in whole, but not in part, at a price of $0.001 per Right, appropriately adjusted to reflect any stock split, stock dividend, recapitalization or similar transaction occurring after the date of the adoption of the Tax Plan (the “Redemption Price”). The redemption of the Rights may be made effective at such time, on such basis and with such conditions as the Board of Directors in its sole discretion may establish. Immediately upon any redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Amendments. For so long as the Rights are then redeemable, the Company may amend the Tax Plan in any manner. After the Rights are no longer redeemable, the Company may amend the Tax Plan (i) to cure any ambiguity or to correct or supplement any provision which may be defective or inconsistent with any other provision or (ii) to make any other changes or provisions which the Company may deem necessary or desirable; provided, however, that no such supplement or amendment will adversely affect the interests of the holders of Rights (other than an Acquiring Person), and no such supplement or amendment will cause the Rights again to become redeemable or cause the Tax Plan again to become amendable as to an Acquiring Person; provided further, that the right of the Board of Directors to extend the Distribution Date shall not require any amendment or supplement under the Tax Plan.

Additional Information

On April 15, 2024, a purported stockholder of the Company filed a complaint in the Delaware Court of Chancery against the Company and the members of the Board of Directors. The complaint is captioned Penston v. Meniane, C.A. No. 2024-0397-PAF and is referred to as the “Complaint.” The Complaint challenged certain aspects of the definition of “Beneficial Ownership” in the Tax Plan and sought to enjoin enforcement of the Tax Plan, asserting that the Tax Plan’s definition of “Beneficial Ownership” could be triggered by an agreement, arrangement, or understanding that would not be considered a change in “economic ownership” under Section 382 of the Code.

CarParts.com, Inc. 21 2024 Proxy Statement

The Company believes that the allegations in the Complaint are without merit. Solely to avoid the cost of litigation, the Company agreed to make clarifying amendments to the Tax Plan to eliminate any perceived ambiguity concerning the definition of “Beneficial Ownership” in the Tax Plan. On April 23, 2024, the parties filed a stipulation to dismiss the Complaint, which was entered as an order of the Court on April 24, 2024. In connection with such dismissal, the Company has agreed to pay plaintiff’s counsel a mootness fee of $100,000.

On April 24, 2024, the Company amended the Tax Plan to reflect the clarifying edits described above. The amendment is attached to this proxy statement as Appendix C. All references to the Tax Plan, the Tax Benefit Preservation Plan or similar concepts in this proxy statement or in the proxy card will be deemed to be references to the Tax Plan as so amended.

Vote Required

Approval of this Proposal Two requires the affirmative vote of a majority of the voting power of the stockholders present in person or by proxy and entitled to vote at the Annual Meeting and on the proposal. Abstentions will be counted as present and entitled to vote on the proposal and will therefore have the same effect as a vote against the proposal. Brokers do not have discretionary authority to vote on this proposal. Broker non-votes, if any, will have no effect on the vote.

Recommendation of Our Board of Directors

Our Board Of Directors recommends that the stockholders vote “FOR” the ratification of the Tax Benefits Preservation Plan. |

CarParts.com, Inc. 22 2024 Proxy Statement

Ratification of Appointment of Independent Registered Public Accounting Firm

RSM US LLP (“RSM”) has audited our consolidated financial statements since 2015. The Audit Committee has appointed RSM to continue in this capacity for the fiscal year ending December 30, 2024 (“fiscal 2024”). We are asking our stockholders to ratify the appointment by the Audit Committee of RSM as our independent registered public accounting firm to audit our consolidated financial statements for fiscal 2024 and to perform other appropriate services. Stockholder ratification of the appointment of RSM as our independent registered public accounting firm is not required by the Bylaws or otherwise. In the event that our shareholders fail to ratify the selection, it will be considered a recommendation to the Board of Directors and the Audit Committee to consider the selection of a different firm. Even if the appointment is ratified, the Audit Committee, in its sole discretion, may direct the appointment of a different independent accounting firm at any time if the committee feels that such a change would be in our best interests and in the best interests of our stockholders.

A representative of RSM is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

Recommendation of Our Board of Directors

Our Board Of Directors recommends that the stockholders vote “FOR” the ratification of the appointment of RSM as our independent registered public accounting firm for fiscal 2024. |

CarParts.com, Inc. 23 2024 Proxy Statement

Principal Accountant Fees

The following table sets forth the fees billed to us for fiscal years 2023 and 2022 by RSM:

| | | Fiscal 2023 | | | Fiscal 2022 | |

Audit Fees | | | $1,270,500 | | | $1,317,750 |

Audit Related Fees | | | $42,000 | | | $21,000 |

Tax Fees | | | $8,400 | | | $9,975 |

All Other Fees | | | — | | | — |

Total | | | $1,320,900 | | | $1,348,725 |

Audit Fees. Audit fees consisted of fees billed by RSM for professional services rendered in connection with the audit and quarterly reviews of our consolidated financial statements.

Audit Related Fees. Audit related fees for fiscal 2023 consisted of fees billed by RSM for professional services rendered in connection with reviews of registration statements and other accounting consultations not qualifying under audit fees.

Tax Fees. Tax fees include fees for tax compliance, tax advice and tax planning services.

All Other Fees. All other fees relate to services not captured in the audit, audit-related, or tax categories.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services

All engagements for services by RSM are subject to prior approval by the Audit Committee pursuant to the pre-approval policy set forth in the charter of the Audit Committee; however, de minimis non-audit services may instead be approved in accordance with applicable SEC rules. The Audit Committee may also delegate to one or more designated members of the Audit Committee the authority to grant such preapprovals, provided that the decision of any member to whom authority is so delegated shall be presented to the full Audit Committee at its next scheduled meeting. The Audit Committee approved all services provided by RSM for fiscal years 2023 and 2022.

CarParts.com, Inc. 24 2024 Proxy Statement

The following is the report of the Audit Committee with respect to the Company’s audited consolidated financial statements for the fiscal year ended December 30, 2023 included in the Company’s Annual Report on Form 10-K for that year.

In carrying out its responsibilities under the Audit Committee Charter, which is available by accessing the investor relations section of our website at https://www.carparts.com/investor/corporate-governance#governance-documents, the Audit Committee, among other things, supervises the relationship between the Company and its independent auditors, including making decisions with respect to their appointment or removal, reviewing the scope of their audit services, pre-approving audit engagement fees and non-audit services and evaluating their independence. The Audit Committee oversees and evaluates the adequacy and effectiveness of the Company’s systems of internal and disclosure controls and internal audit function. The Audit Committee has the authority to investigate any matter brought to its attention and may engage outside counsel for such purpose.

The Company’s management is responsible, among other things, for preparing the financial statements and for the overall financial reporting process, including the Company’s system of internal controls. The independent auditor’s responsibilities include (i) auditing the financial statements and expressing an opinion on the conformity of the audited financial statements with U.S. generally accepted accounting principles (“GAAP”) and (ii) auditing the financial statements and expressing an opinion on management’s assessment of, and the effective operation of, the Company’s internal control over financial reporting.

The Audit Committee met four times during fiscal 2023. The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Audit Committee’s meetings include sessions with the Company’s independent auditor and management present and regular sessions without the presence of the Company’s management.